Don't Ditch Your BPO — Supercharge it with AI

TL;DR: Key Takeaways

- AI isn't meant to replace BPO partnerships — it's designed to make them exponentially more effective

- Human-in-the-loop AI enables BPO teams to process submissions 5X faster while maintaining 100% accuracy

- Your existing BPO infrastructure can be enhanced with intelligent document processing without operational disruption

- The winning formula combines BPO scalability with AI-powered data extraction for optimal results

- Forward-thinking insurers are already seeing dramatic improvements by augmenting, not abandoning, their BPO models

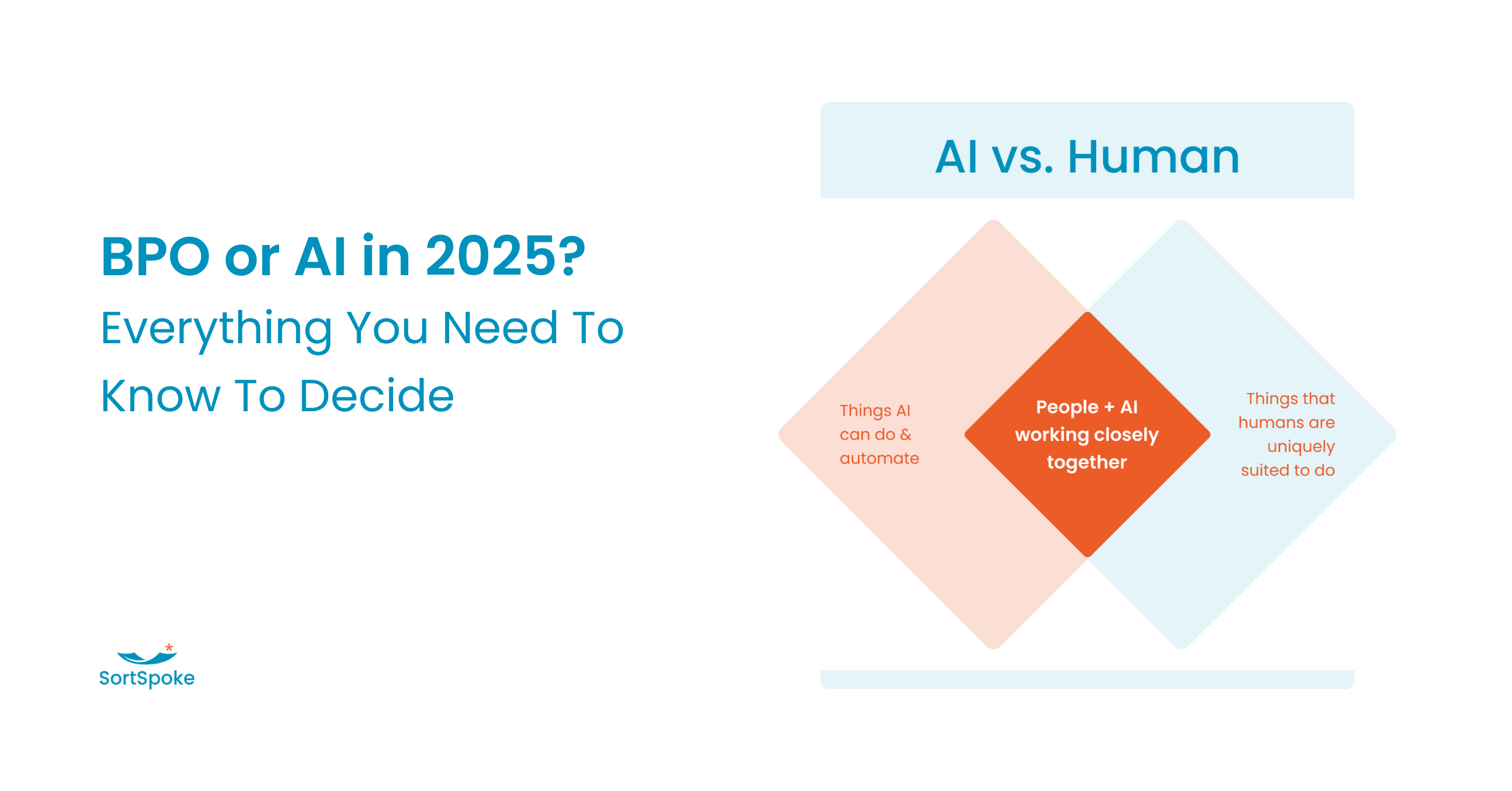

The insurance industry is buzzing with talk about AI replacing traditional business processes. Walk into any industry conference, and you'll hear dire predictions about the "death of BPO" and the rise of fully automated operations. But here's the thing: the smartest insurance leaders aren't choosing between BPO and AI — they're combining them.

If you've spent years building successful partnerships with Business Process Outsourcing (BPO) providers, you don't need to tear it all down and start over. The real question isn't whether AI will eliminate your outsourcing relationships. It's how AI can make your existing BPO partnerships dramatically more effective.

Think of it this way: you wouldn't throw away a perfectly good car just because someone invented better tires. You'd upgrade the tires and enjoy a smoother, faster ride. The same principle applies to your BPO operations.

Why BPO Still Matters in Insurance

Before we dive into the AI discussion, let's acknowledge why BPO partnerships became so valuable in the first place. BPO vendors provide distinct advantages that remain relevant today:

Scalable staffing for predictable peaks. Whether it's renewal season, catastrophe claims surges, or new business campaigns, BPO partners help you flex capacity without the overhead of permanent hires.

Deep insurance expertise. Your BPO teams understand ACORD forms, loss runs, SOVs, and the nuances of insurance documentation. They're not just data entry clerks — they're specialists who speak your language.

Cost efficiency that protects margins. In an industry where every basis point matters, BPO partnerships help carriers and MGAs maintain competitive cost structures.

Established workflows and quality controls. You've invested time and resources training these teams, building processes, and establishing quality standards. That infrastructure has real value.

The challenge isn't that BPO doesn't work — it's that traditional BPO models weren't designed for the complexity and volume of modern insurance operations.

The Real Problem: It's the Process, Not the People

Here's what's actually happening in most BPO operations: highly skilled insurance professionals spend 80% of their time on repetitive, low-value tasks. They're manually extracting data from PDFs, hunting through multi-page documents for specific fields, and reformatting information that should flow seamlessly between systems.

A typical day for a BPO analyst looks like this:

- Opens a 75-page commercial submission package

- Manually reviews certificates of insurance, loss runs, and financial statements

- Types data into multiple systems, field by field

- Double-checks for errors and missing information

- Moves to the next submission

This isn't a people problem — it's a tools problem. Your BPO teams are capable of much more sophisticated work, but they're constrained by manual processes that haven't evolved with the complexity of modern insurance documents.

The bottleneck isn't human capacity; it's the time spent on mechanical tasks that could be automated, leaving humans free to focus on judgment, analysis, and exception handling.

Comparing Your Options: BPO vs. AI vs. AI-Enhanced BPO

Before you decide how to modernize your operations, let's look at what each approach actually delivers:

| Capability | Traditional BPO Only | AI-Enhanced BPO |

|---|---|---|

| Processing Speed | 45-60 minutes per submission | 5-8 minutes per submission |

| Accuracy Rate | 85-90% (human error prone) | 98-100% (AI + human validation) |

| Complex Document Handling | Excellent (human judgment) | Excellent (AI efficiency + human judgment) |

| Compliance & Auditability | Good (manual documentation) | Excellent (full transparency) |

| Implementation Time | Already established | 2-4 weeks |

| Scalability | Limited (requires more staff) | Very High (efficient + flexible) |

| Cost per Submission | $15-25 | $3-8 |

| Learning & Improvement | Slow (training dependent) | Continuous (AI learns from humans) |

| Risk of Disruption | Low | Minimal |

The verdict is clear: AI-enhanced BPO delivers the best of both worlds — combining the speed and efficiency of AI with the judgment and expertise of human professionals, all while minimizing operational risk.

AI + BPO: The Best of Both Worlds

The most successful insurance companies aren't viewing AI as a BPO replacement — they're using it as a BPO enhancement. This hybrid approach combines the strengths of both:

Intelligent document processing handles the heavy lifting of data extraction across any document type — PDFs, Excel files, photos, scanned images — without requiring rigid templates or predefined forms.

Human-in-the-loop validation (HITL)ensures accuracy and maintains control. BPO analysts review AI suggestions, make corrections, and provide feedback that continuously improves the system's performance.

Real-time learning means the AI gets smarter with every submission. When a BPO analyst corrects an extraction or adds context, the system learns and applies that knowledge to future documents.

Complete auditability maintains compliance and documentation standards. Every extraction is traceable, every decision is logged, and every modification is tracked for regulatory requirements.

This isn't about replacing expertise — it's about amplifying it. Your BPO teams stay in control while gaining superpowers.

What This Looks Like in Practice

Let's walk through a real-world scenario. A BPO analyst receives a complex commercial property submission:

The old way: The analyst manually opens each document, scans for relevant information, and transcribes data into multiple systems. Total time: 45-60 minutes per submission.

The AI-enhanced way: The analyst opens a unified interface powered by intelligent document processing. Within seconds, the system has:

- Automatically identified and extracted key data points across all documents

- Flagged high-confidence extractions in green

- Highlighted low-confidence areas in yellow for review

- Presented everything in a clean, organized format

The analyst reviews the suggestions, makes any necessary corrections, and approves the extraction. Total time: 5-8 minutes per submission.

The result? 5X faster processing with 100% accuracy. The AI handles the mechanical work, while the human brings judgment, context, and expertise to the equation.

But here's the best part: as the analyst makes corrections, the AI learns. Next time it encounters a similar document type or underwriting scenario, it gets a little bit smarter. Your BPO operations don't just get faster — they get better over time.

Rethink the Role of AI: It's an Enabler, Not a Replacement

The insurance industry has been burned by technologies that promised to eliminate human involvement entirely. Remember when OCR was supposed to solve all document processing problems? Or when rule-based systems were going to automate underwriting?

The future of insurance operations isn't human or machine — it's human and machine. AI should enhance human capabilities, not replace them. Here's why this matters:

Insurance requires judgment. Risk assessment, underwriting decisions, and claims evaluation involve nuance that only human experts can provide. AI can inform these decisions, but it shouldn't make them alone.

Compliance demands accountability. Regulatory requirements mean humans need to be in the loop for key decisions. AI recommendations must be reviewable, explainable, and auditable.

Context matters. An experienced BPO analyst can spot when something doesn't look right — unusual policy limits, inconsistent information, or red flags that require investigation. AI provides data; humans provide wisdom.

By positioning AI as an enabler rather than a replacement, you get the benefits of both: machine efficiency with human oversight.

Getting Started: Augmenting Your Existing BPO

If you're convinced that AI can enhance your BPO operations, here's how to begin:

Start with a pilot program. Choose a specific document type or process where you can measure clear before-and-after results. This allows you to demonstrate value without disrupting your entire operation.

Focus on integration, not replacement. Look for AI solutions that integrate with your existing systems and workflows. The goal is to enhance what works, not rebuild from scratch.

Train your BPO teams. AI adoption requires change management. Invest in training that shows your BPO analysts how AI makes their jobs easier and more interesting, not redundant.

Measure what matters. Track processing time, accuracy rates, exception handling, and team satisfaction. The ROI should be clear and compelling.

Scale gradually. Once you've proven the concept, expand to additional document types and processes. Let success drive adoption.

The Competitive Advantage of AI-Enhanced BPO

Companies that successfully combine AI with BPO operations gain several competitive advantages:

Faster time-to-quote. When submissions are processed 5X faster, you can respond to prospects while competitors are still sorting through documents.

Higher accuracy rates. Human-in-the-loop AI dramatically reduces errors compared to purely manual processes, improving customer satisfaction and reducing rework.

Better scalability. You can handle volume spikes without proportional increases in headcount, improving operational flexibility.

Enhanced analytics. AI-extracted data provides better insights into submission trends, helping underwriters make more informed decisions.

Future-proofing. You're building capabilities that will become table stakes in the industry. Early adopters gain sustainable advantages.

Conclusion: Augment, Don't Abandon

Final Thoughts on AI-Enhanced BPO

Your BPO partnerships represent years of investment in training, processes, and relationships. That investment doesn't become worthless because AI exists — it becomes more valuable when enhanced with the right technology.

The insurance companies winning in today's market aren't the ones that abandoned their existing operations for the latest technology trend. They're the ones that thoughtfully enhanced what already worked with tools that make it work even better.

The question isn't whether you need BPO or AI. The question is: when will you start combining them for maximum advantage?