Insurance-Specific AI with Human-in-the-Loop Outperforms Generic AI

Published May 21, 2025 | Updated February 12, 2026

TL;DR

- Generic AI hallucinates 15% of the time: Insurance-specific AI with human-in-the-loop validation eliminates this risk entirely — every data point is verified before it reaches an underwriter's desk

- HITL is an architecture, not a compromise: Human oversight creates a 4x trust multiplier and turns pilots into production systems that actually scale

- Embeddable + HITL is the combination that works: AI inside your existing workflows with human control means no new portals, no disruption, and teams that actually adopt it

Trust Is the Real Bottleneck — And Generic AI Makes It Worse

Even GPT-4.5 — the most capable general-purpose AI model available — hallucinates 15% of the time. For a consumer asking trivia questions, that's an annoyance. For an underwriter evaluating a $2M commercial property submission, that's a disqualifier.

Yet most insurance organizations evaluating AI are still starting with generic tools — ChatGPT, Copilot, off-the-shelf document processing — hoping that "good enough" intelligence can handle insurance-grade work. It can't. And the 78% of AI pilots that never scale to production are proof.

The problem isn't that AI doesn't work. It's that generic AI doesn't earn trust. Underwriters don't resist technology because they're change-averse — they resist it because they've seen it produce confident, plausible, wrong answers. And in insurance, wrong answers have consequences.

In 2026, insurance leaders face a real choice: keep experimenting with generic AI and wonder why adoption stalls, or invest in insurance-specific AI with human-in-the-loop validation that eliminates hallucination and builds the trust required for production-scale deployment.

Built on Insurance Expertise, Not Just Data Science

General AI models process text as statistical patterns. They don't understand the difference between a submission form, a loss run report, and a policy endorsement. They can't map relationships between a 40-page submission package where the named insured on page 3 needs to match the entity on the ACORD 125 on page 12. They suffer from context collapse on multi-page documents — losing track of which data belongs to which section, which coverage applies to which location.

These aren't edge cases. They're the everyday reality of commercial underwriting.

Insurance-specific AI solutions like SortSpoke are built differently. They're trained on actual insurance documents — ACORD forms, loss runs, SOVs, endorsements, supplemental applications — not web-scraped text that happens to mention insurance. This specialized training means the AI understands document hierarchies, knows what information underwriters need from each document type, and can extract structured data from unstructured submissions with precision that generic models can't match.

Even the most advanced general-purpose AI models hallucinate roughly 15% of the time — generating confident, plausible information that is simply wrong. In insurance document processing, a 15% error rate on extracted data means mispriced policies, missed exclusions, and regulatory exposure. Source: insurance-canada.ca

Some competitors claim to be "insurance-native" while running generic models with an insurance wrapper. The difference matters: SortSpoke's AI is built on the documents your underwriters actually process, not on a relabeled general-purpose engine. That's why most AI pilots fail — they start with the wrong foundation.

The Human-in-the-Loop Difference: Control + Efficiency

The most effective AI in insurance doesn't attempt to replace human expertise — it amplifies it. This is the philosophy behind the $480M bet that humans still matter: organizations investing in human-AI collaboration are outperforming those chasing full automation.

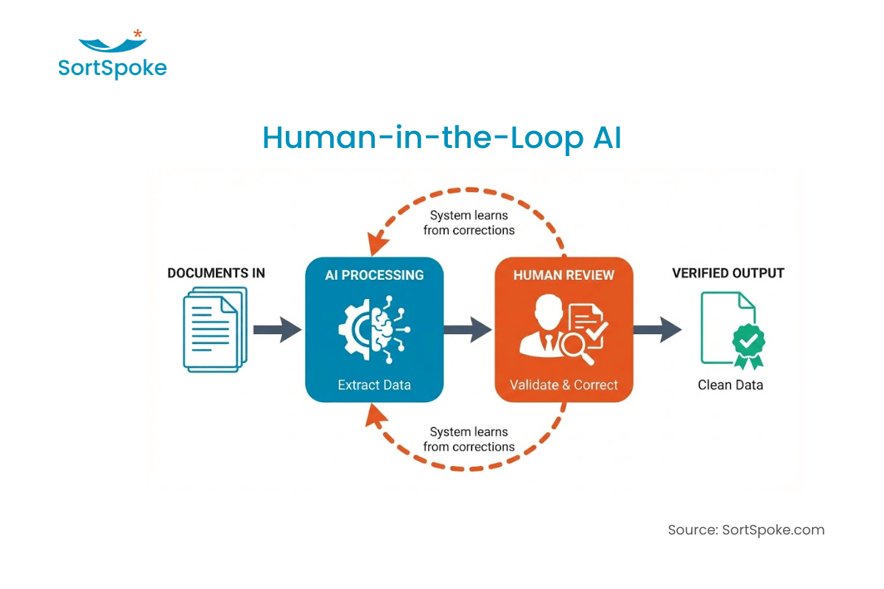

Human-in-the-Loop (HITL) AI

Human-in-the-Loop AI — an architecture that combines machine intelligence with human expertise. AI handles initial document processing and data extraction while humans provide oversight, validation, and judgment.

In insurance, HITL means AI extracts information from complex submissions while underwriters verify accuracy, interpret context, and make nuanced decisions — creating a system more accurate and trustworthy than either humans or AI working alone.

Eliminating the Hallucination Risk

In insurance underwriting, accuracy isn't aspirational — it's non-negotiable. A single hallucinated data point in an extracted loss run can lead to significant mispricing or inappropriate risk acceptance.

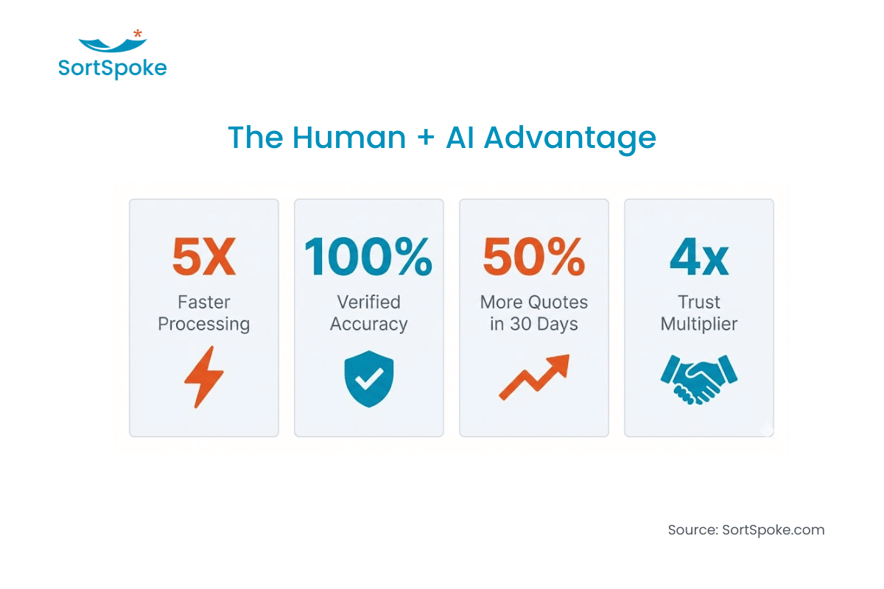

Human-in-the-loop validation ensures that every piece of extracted data is verified by an expert before it enters the underwriting workflow. The result: 100% accuracy on validated data while still achieving 5x faster processing. Not 99%. Not "industry-leading." One hundred percent — because an underwriter confirms every output.

This is what gives HITL its 4x trust multiplier. When underwriters can see exactly where data came from — traced to document, page, and section — and can override the AI when needed, they trust it. Teams that can override AI use it more, not less.

Continuous Learning Without Disruption

Each time an underwriter validates or corrects AI-extracted data, the system learns and improves. This creates an ongoing cycle where the AI becomes increasingly accurate over time — without requiring data scientists to retrain models or specialized technical skills from the underwriters themselves.

This is evolution over revolution. Successful AI adoption is iterative, not transformational. Organizations that design for gradual improvement outperform those betting on Day 1 perfection. Start with one document type, expand as confidence grows. The AI gets better because your team is teaching it, not because a vendor shipped an update.

As the underwriting talent crisis deepens — with experienced underwriters retiring and taking decades of institutional knowledge with them — this continuous learning loop becomes critical infrastructure. Every correction an expert makes is captured, preserved, and applied to future documents.

Full Transparency and Auditability

Insurance decisions must be explainable and auditable. The black-box nature of many general AI solutions creates significant compliance and transparency issues.

While others promise autonomous AI decisions, SortSpoke keeps your team in control. AI extracts. Humans decide. Every data point is traceable to its source document, page, and section — essential for regulatory compliance, audit trails, and defending underwriting decisions.

"SortSpoke solves one of underwriting's messiest problems. Enables faster reviews, better risk assessment, greatly reduced manual effort."

— VP Underwriting, RGA

Embeddable Architecture: AI That Meets Your Team Where They Work

Here's the uncomfortable truth about most AI implementations: even when the technology works, teams don't use it. Why? Because it requires logging into yet another portal, learning yet another interface, and disrupting the workflows that actually get work done.

HITL only delivers its full value when humans can easily access the AI where they already work. That's why SortSpoke's embeddable architecture is the other half of the equation — document AI built into the tools your team already uses. No new portals. No new logins. Documents get processed where work already happens.

Embedded tools see 3-5x higher adoption than standalone platforms. If your team has to log into a new portal, you've already lost. The best AI is the AI your people actually use — and that means meeting them in the tools they already rely on.

Some competitors claim "plug-and-play" integration without evidence. SortSpoke's embeddable architecture is built for platforms from the ground up — enterprise-ready document AI designed to work inside your existing systems, not alongside them. AI adapts to your workflow, not the other way around.

The combination of human-in-the-loop validation and embeddable delivery is what makes the difference: accurate AI that your team controls, delivered inside the tools they already trust. That's not a feature list — it's a deployment architecture designed for real-world adoption.

Regulatory Compliance by Design

Insurance operates under strict regulatory frameworks that vary by state, line of business, and jurisdiction. For insurance operations, compliance isn't an afterthought — it's fundamental to system design.

Insurance-specific AI incorporates compliance at its core, with built-in safeguards for:

- Protected health information (HIPAA)

- Personal data (GDPR/CCPA)

- Fair lending requirements

- State-specific regulations

- Document retention requirements

- Full audit trails with source traceability

- Role-based access controls

- Complete explainability for every AI decision

Generic AI models typically lack these specific compliance controls, creating potential regulatory exposure when implemented in insurance environments. Claiming compliance without evidence — as some competitors do — isn't the same as building it into the architecture.

Real-World Impact: Transforming Underwriting Efficiency

When evaluating AI for insurance, the proof is in results from real customers with real names — not anonymous case studies or vague claims.

Insurance companies implementing domain-specific AI with human-in-the-loop validation are seeing measurable improvements:

- 50% increase in submission-to-quote ratio within just 30 days

- 5X faster submission processing while maintaining 100% accuracy on validated data

- Dramatic reduction in manual data entry, freeing underwriters to focus on analysis and decision-making

- Higher bind rates through faster quote turnaround

- Improved underwriter satisfaction by eliminating tedious document processing tasks

"Great accuracy levels achieved. Training was quick. SortSpoke stood out among competitors evaluated."

— Manager, Global Digital Underwriting, RGA

"User-friendly interface for extracting unstructured document information. No competitor offers similar workflow correction capability."

— Assistant VP Analytics

These aren't anonymous testimonials. RGA is one of the world's largest reinsurers, and their underwriting team chose SortSpoke after evaluating competitors head-to-head. Compare that to vendors with zero named customer references — and ask what that absence tells you.

Ready to see how your team's operations compare? Learn how to staff your human-in-the-loop operation for maximum impact.

See what insurance-specific AI with human-in-the-loop validation can do for your team. Book a demo or calculate your ROI to get started.