Case Study: RGA Accelerates Underwriting Innovation with SortSpoke

Revolutionizing Life Reinsurance Underwriting with AI-Powered Data Extraction

50%

30%

Customer & Use Case Overview

This client is a large re-insurance carrier with operations worldwide.

30K

Annual Submissions

100+

Underwriting Team Members

1,000+

Hours Spent on Manual Processing Every Week

TL:DR

Transforming Life Underwriting with AI-Driven Efficiency

Manual document processing has always been a major headache for insurers like Great American Custom Insurance.

- Use Case & Pain Points: addressed inefficiencies in underwriting through AI-driven data extraction.

- 50% reduction in manual data entry: enabling underwriters to focus on high-value tasks.

- 30% faster underwriting cycle times: accelerating risk assessment and policy approvals.

- Enhanced accuracy and efficiency: reducing human errors and improving risk evaluation.

- Seamless integration: allowing RGA to implement AI-driven data extraction without disrupting workflows.

- Scalable solution: supporting expansion across multiple lines of business and global markets.

Document processing was a persistent pain point across divisions. Their greatest concern was the excessive manual labor needed from team members to process files, wrangle unstructured data and input information into their system.

Spotlight on Documents

Unstructured, high-variation medical reports

At the heart of RGA’s underwriting challenges was the sheer volume of unstructured data that had to be manually processed. Underwriters were spending significant time extracting, validating, and reviewing key information from a variety of document types—each presenting unique challenges in format, structure, and complexity.

Key Document Challenges:

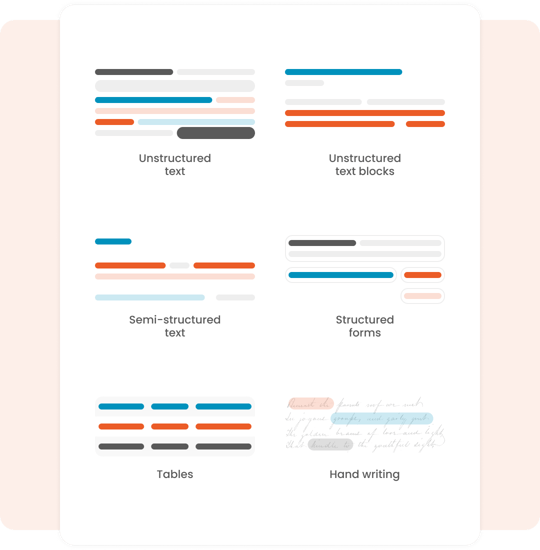

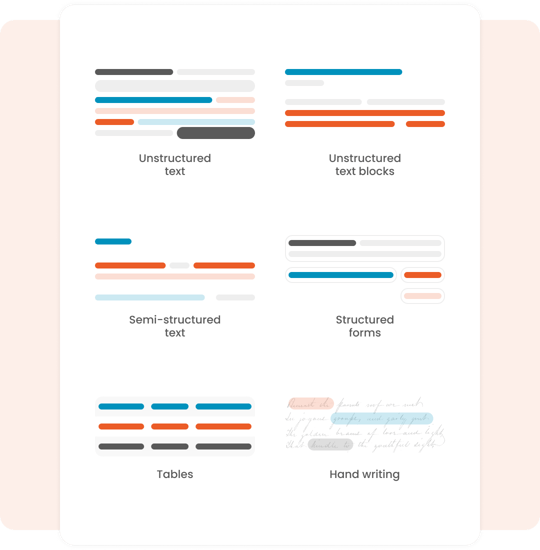

📌 High Variability – Documents arrived in multiple formats, including handwritten notes, PDFs, scanned forms, and mixed-structure tables, making standard data extraction difficult.

📌 Manual Review Bottlenecks – Underwriters had to painstakingly extract and validate each piece of information, leading to delays in decision-making.

📌 Risk of Errors & Inconsistencies – Manually entered data increased the potential for human errors, which could impact underwriting accuracy and risk assessment.

Key Document Types Processed with SortSpoke:

✅ Medical Questionnaires – These documents contain detailed health histories required for risk evaluation. SortSpoke’s AI-powered extraction helped quickly identify key medical conditions, medications, and past procedures, reducing review time.

✅ Application Forms – Life insurance applications contain a mix of structured and unstructured data, including personal details, financial history, and policy preferences. SortSpoke automated data extraction from these forms, ensuring consistency and accuracy.

✅ Diagnostic Reports – Underwriters rely on specialized medical reports such as lab results, imaging reports, and physician assessments to make risk determinations. SortSpoke’s ability to extract and validate key details from these complex reports streamlined the underwriting process.

By leveraging SortSpoke, RGA eliminated the need for manual re-entry, reduced processing time, and ensured greater accuracy in underwriting decisions—all while allowing underwriters to maintain oversight on critical cases.

Tired of Inefficient Underwriting Processes?

Process incoming submissions 5X faster than doing them manually with 100% accuracy with SortSpoke.

RGA's Challenges

Decentralized Structure and Process Chaos

Despite being a leader in the life reinsurance industry, RGA faced significant operational inefficiencies due to its reliance on manual data entry. Underwriters were spending valuable time extracting, reviewing, and validating data from a wide variety of documents—slowing down decision-making and increasing the risk of human error. As the demand for faster, more accurate underwriting grew, these challenges became more pronounced.

RGA’s key challenges included:

- Manual Processing Bottlenecks – Underwriters were spending hours manually extracting critical information from unstructured documents like medical histories, application forms, and financial reports. This time-consuming process diverted skilled professionals from higher-value tasks like risk assessment and decision-making.

- Slow Turnaround – Due to the labour-intensive nature of document processing, some underwriting reviews took several days to complete. Delays in retrieving, reviewing, and verifying data led to inefficiencies, making it difficult to provide timely responses to clients.

- Complex Data Formats – RGA dealt with a wide variety of document types, including scanned handwritten forms, structured PDFs, and mixed-format submissions. Extracting and validating key underwriting data from these diverse formats required a highly adaptable and intelligent solution.

With increasing underwriting volumes and the need for greater accuracy, RGA recognized that automation was essential to maintaining its competitive edge. The company sought a solution that could eliminate manual inefficiencies, accelerate processing times, and ensure seamless integration with its underwriting workflows—without compromising underwriter expertise.

The Solution

AI-Powered Data Capture & Validation with SortSpoke

To overcome its underwriting challenges, RGA selected SortSpoke for its ability to streamline document processing while maintaining underwriter oversight. The solution provided immediate value by reducing manual effort and improving accuracy across complex submissions.

RGA chose SortSpoke for its:

✅ Seamless Integration – The platform was rapidly deployed without disrupting existing underwriting workflows, ensuring a smooth transition with minimal IT overhead.

✅ Automated Data Extraction & Validation – SortSpoke’s AI-driven capabilities automatically captured and validated key information from unstructured documents, significantly reducing errors while keeping underwriters in the loop for final review.

✅ Support for Large Submissions – The system efficiently handled high-volume, complex underwriting cases, cutting processing time and allowing teams to focus on higher-value risk assessments.

By implementing SortSpoke, RGA has successfully modernized its underwriting process, reducing delays and enhancing decision-making capabilities without sacrificing the human expertise that sets it apart.

The New Approach

Learn How To Boost Your Submission Processing By 2X

Process incoming submissions 5X faster than doing them manually with 100% accuracy with SortSpoke.

Revolutionizing Life Reinsurance Underwriting with AI-Powered Data Extraction

.png?width=500&height=300&name=Teranet%20SortSpoke%20Case%20Study%20(1200%20x%20628%20px).png)