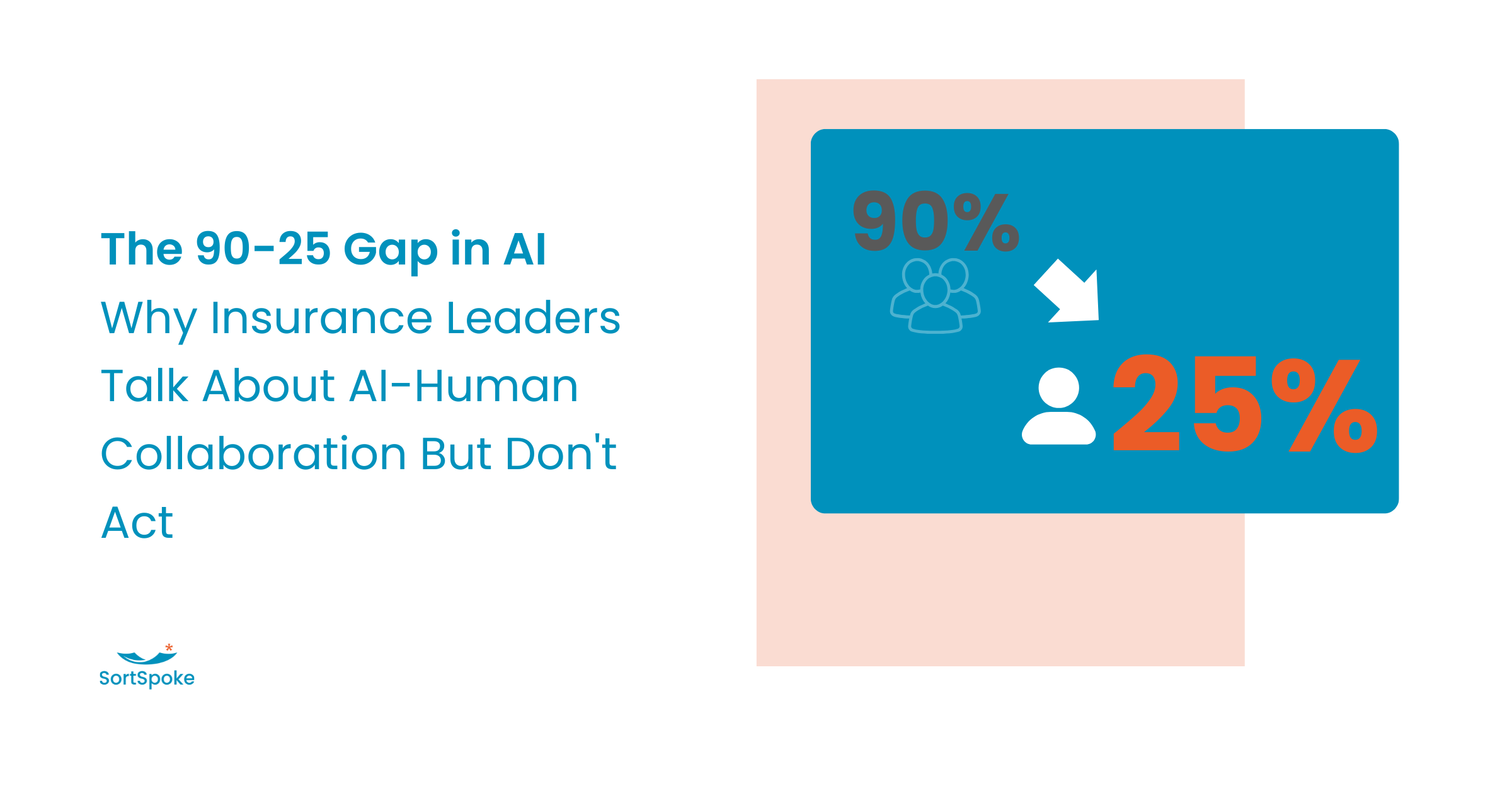

The 90-25 Gap: Why Insurance Leaders Talk About AI But Don't Act

TL;DR

- 90% of insurance executives agree that reinventing work for AI-human collaboration is urgent, but only 25% have taken action

- The gap isn't technical—it's about overcoming barriers like legacy systems, talent gaps, cultural resistance, and implementation paralysis

- The 25% who've acted are processing submissions faster, attracting better talent, and building competitive advantages that will be hard to replicate

- Underwriting represents an ideal starting point for AI augmentation with clear metrics and measurable ROI

- Moving now while there's still competitive advantage to gain is critical—the window is narrowing

- Success requires starting before conditions are perfect, framing AI as augmentation not automation, and focusing on business outcomes over technology

Here's a number that should make every insurance executive uncomfortable: 90% agree that reinventing the employee value proposition to reflect human-machine collaboration is urgent. Yet only 25% have taken tangible action to elevate human skills in an AI-augmented environment.

If you're reading this, you're likely in the 90%.

You understand the vision. You've seen the demos. You've attended the conferences where consultants explain how AI will "augment, not replace" your workforce. You've nodded along when speakers describe underwriters processing 5X more submissions without sacrificing quality. You might have even approved budget for a pilot project.

But you haven't moved. Not really. Not at the scale and speed required to maintain competitive advantage.

This gap between understanding and action isn't a minor operational delay. It's a strategic vulnerability. While your organization deliberates, analyzes, and waits for perfect conditions, the 25% who have already acted are pulling ahead—processing submissions faster, attracting better talent, and building institutional knowledge about what works in AI implementation.

The question isn't whether you'll eventually join them. Market forces will ensure that. The question is whether you'll join them while there's still competitive advantage to be gained, or after they've already captured it.

The Agreement: Why 90% Know Collaboration is Key

The intellectual case for human-AI collaboration in insurance is airtight. According to Deloitte's 2026 Global Insurance Outlook, the evidence is overwhelming across every dimension that matters:

The efficiency case: Insurers are implementing AI for fraud detection (with potential savings up to $160 billion by 2032), underwriting assistance (allowing review of additional policies without adding staff), and claims processing (dramatically improving customer satisfaction scores).

The competitive case: Premium growth is slowing, margins are under pressure, and operational complexity is increasing. Carriers that can process more submissions with existing teams while maintaining or improving quality have a clear advantage.

The talent case: The industry faces a three-generation workforce challenge—veterans retiring with irreplaceable knowledge, mid-career professionals needing to reskill, and new graduates seeking innovative environments. Organizations that can't demonstrate AI maturity struggle to recruit and retain talent at all levels.

The customer case: Policyholders expect faster responses, more personalized service, and seamless digital experiences. Delivering these expectations at scale requires augmenting human judgment with intelligent automation.

Every executive survey, every market analysis, every consultant presentation makes the same point: human-AI collaboration isn't optional; it's the operating model of the future. The 90% who agree aren't wrong—they understand the destination clearly.

So why aren't they moving?

The Reality: Why Only 25% Act

Understanding what you should do and actually doing it are separated by barriers that feel insurmountable. Let's be direct about what's stopping you.

Barrier 1: Legacy Systems and Data Chaos

The problem: Your data isn't clean. It's fragmented across multiple systems, inconsistent in definition and format, and managed by teams who built workarounds years ago that have calcified into "how we do things." You can't build modern AI on this foundation, and you know it.

Why it matters: When you talk to AI vendors, they ask about data readiness. When you talk to your IT team, they explain why modernization is a multi-year project. When you talk to your CFO, they question investing in infrastructure that might be obsolete by the time it's deployed. The uncertainty creates paralysis.

They accepted that perfect data hygiene isn't required for every AI project. As the Deloitte report emphasizes, "proper standardization and control can be critical to avoid conflicting results and maintain trust," but you don't need to fix everything before you start. The 25% created adaptable architectures aligned with business goals, prioritizing data quality for specific high-value use cases rather than attempting wholesale transformation.

They also recognized that some AI applications can actually help clean data rather than requiring clean data as a prerequisite. The key is starting with contained, high-value problems rather than enterprise-wide initiatives.

Objection addressed: "Our data isn't clean enough" is often an excuse for inaction rather than a genuine technical constraint. The question isn't whether your data is perfect—it never will be. The question is whether it's sufficient for specific, targeted AI implementations that deliver measurable value.

Barrier 2: Talent Gaps Across Three Generations

The problem: New graduates enter with AI and machine learning expertise but little insurance domain knowledge. They're eager to work on transformative initiatives, but your organization is still running pilots. Mid-career professionals are deeply embedded in legacy systems and workflows, uncertain about their relevance in an AI-augmented future. Veteran underwriters are retiring, taking irreplaceable institutional knowledge with them.

Why it matters: You can't train your existing workforce fast enough, can't recruit the talent you need, and can't afford to lose the expertise you have. This creates a talent trap: you need AI maturity to attract AI talent, but you need AI talent to build AI maturity.

They adopted what Deloitte calls a "broad, agile framework" that includes building new skills through experiential projects, hiring specialized talent for specific capabilities, borrowing capabilities through partnerships, automating repetitive tasks to free human capacity, and redesigning workflows to integrate human talent with AI.

Critically, they stopped trying to develop every skill internally. The most successful implementations involved partnerships with technology providers who could deliver AI capabilities while the insurer focused on domain expertise and change management.

Barrier 3: Fear of Job Displacement vs. Reality of Augmentation

The problem: When you mention AI to your underwriting team, you hear concern. They've read the articles about automation eliminating jobs. They see AI as a threat to their expertise, their autonomy, and their livelihoods. This resistance—sometimes passive, sometimes active—sabotages implementation before it begins.

Why it matters: You can deploy the most sophisticated AI system in the world, but if your team refuses to use it or actively works around it, you've achieved nothing. Cultural resistance is often the most significant barrier to AI adoption, yet it's the one executives are least equipped to address.

They led with augmentation, not automation. When AIG launched its gen AI-powered underwriting assistant, the message wasn't "we're replacing underwriters." It was "we're enabling underwriters to review additional policies without adding new staff." The technology handles routine data extraction and organization; underwriters focus on complex risk assessment and decision-making.

The 25% also demonstrated that AI augmentation makes jobs more satisfying, not less. By eliminating tedious data entry and routine processing, AI allows insurance professionals to focus on the judgment-intensive work they were trained to do. This requires transparent communication, clear career paths in an AI-augmented environment, and involving staff in implementation rather than imposing technology on them.

Objection addressed: "Our underwriters will resist" is a legitimate concern, but it's often based on framing AI as replacement rather than augmentation. When you show underwriters that AI will handle the parts of their job they dislike (data entry, document review) and enhance the parts they value (risk assessment, decision-making), resistance typically transforms into enthusiasm.

Barrier 4: No Clear Implementation Roadmap

The problem: You're overwhelmed by options. Every vendor claims their solution will transform your business. Every consultant has a framework. Every conference session offers a different perspective on where to start. You've run pilots that demonstrated promise but never scaled to production. You're stuck in analysis paralysis.

Why it matters: The gap between experimentation and execution is where most AI initiatives die. Pilots are seductive—they're low-risk, generate positive press, and satisfy boards asking about AI strategy. But they don't change your business. Without a clear path from pilot to production, you're perpetually experimenting while the 25% are executing.

They stopped treating AI as a separate initiative and started treating it as a capability that enables specific business outcomes. Rather than pursuing AI for AI's sake, they identified clear use cases with measurable ROI: fraud detection that reduces loss ratios, underwriting automation that increases submissions per underwriter, claims processing that improves customer satisfaction scores.

They also accepted that the experimentation phase is ending. As the Deloitte report notes, "insurers have now accelerated their AI agendas...most insurance leaders are now focused on practical AI use cases, with clear return on investment and manageable risk."

Objection addressed: "We're not ready for AI yet" assumes you need comprehensive preparation before starting. The 25% recognized that readiness comes from doing, not from planning. Start with a specific, high-value problem where success is measurable and containable. Build capability through execution, not through preparation.

What Success Looks Like: Closing the Gap

The 25% who have moved from agreement to action share common characteristics. Let's look at what they're actually doing.

Zurich deployed AI technologies to spot claims fraud, using machine learning to detect anomalies in filed claims. The system doesn't replace claims adjusters; it flags suspicious patterns for human review. This augmentation model maintains expert control while dramatically improving detection rates.

AIG launched a gen AI-powered underwriting assistant built with Anthropic and Palantir that ingests and prioritizes every new excess and surplus submission. Underwriters aren't eliminated—they're enabled. The AI handles the routine work of organizing and extracting data from submissions; underwriters focus on risk assessment and decision-making.

Both implementations share key characteristics:

- They keep experts in control: AI recommends, flags, and prioritizes. Humans decide, approve, and maintain accountability. This isn't just about regulatory compliance or risk management—it's about recognizing that insurance fundamentally requires judgment that AI can enhance but not replace.

- They handle complexity without templates: Traditional automation requires standardized processes and structured data. Modern AI handles the messy, unstructured reality of insurance documents—complex submissions with inconsistent formats, handwritten notes, and incomplete information.

- They deliver immediate efficiency gains: The value proposition isn't theoretical. Underwriters process more submissions. Claims adjusters review more cases. Fraud investigators identify more anomalies. The efficiency improvements are measurable from day one.

- They maintain explainability: Every AI-generated insight can be traced back to source documents and explained in terms underwriters understand. This transparency is essential for regulatory compliance, internal trust, and continuous improvement.

These aren't experimental pilots generating white papers. They're production systems processing real submissions, assessing real risks, and delivering real business value.

The Underwriting Opportunity: Where to Start

If you're trying to determine where to begin your journey from the 90% to the 25%, underwriting represents an ideal starting point for human-AI collaboration.

Why underwriting? Because it combines three characteristics that make AI augmentation particularly powerful:

- High-value decisions that require expertise: Underwriting isn't data entry—it's risk assessment that demands domain knowledge, judgment, and experience. AI can't replace this expertise, but it can augment it dramatically.

- Time-consuming document processing: Underwriters spend enormous time extracting data from submissions, organizing information, and validating completeness. This is precisely the work AI excels at handling.

- Clear success metrics: You can measure submission processing time, accuracy rates, and productivity gains. Success isn't subjective—it's quantifiable.

The potential is significant: a 5X speed improvement in submission processing while maintaining 100% accuracy. Not theoretical—achievable with the right approach.

What does "the right approach" look like? Consider how leading implementations work:

AI handles the initial document processing—ingesting submissions, extracting key data points, organizing information into structured formats. But instead of black-box automation, the system maintains human oversight at critical points. Underwriters review, refine, and approve AI-extracted data, ensuring accuracy, compliance, and auditability.

This human-in-the-loop model isn't a compromise or a halfway measure. It's the optimal design for insurance, where stakes are high, regulations are strict, and trust is paramount. The AI learns continuously from human feedback, improving future extractions. Underwriters focus on risk assessment rather than data extraction.

For VP and Director-level leaders championing AI initiatives internally, underwriting offers a compelling case: the efficiency gains are measurable, the augmentation model is clear, and the path from pilot to production is well-defined. You're not asking your organization to make a leap of faith—you're proposing a pragmatic improvement to a specific workflow.

Joining the 25%: Moving from Understanding to Action

The gap between the 90% who understand and the 25% who act isn't primarily about technology, budget, or market conditions. It's about overcoming the barriers between knowing what you should do and actually doing it.

What separates the 25% from the 90%?

- They started before conditions were perfect: They accepted that data would never be completely clean, systems would never be fully modern, and talent would never be perfectly aligned. They started anyway, with specific, contained use cases that delivered measurable value.

- They framed AI as augmentation, not automation: They communicated clearly to their workforce that AI would enhance their capabilities, not replace their jobs. They involved staff in implementation rather than imposing technology on them.

- They focused on business outcomes, not technology: They stopped asking "What can AI do?" and started asking "What business problems can we solve?" The technology was a means to an end, not an end in itself.

- They built partnerships: They recognized they couldn't develop every capability internally. The most successful implementations involved collaborating with technology providers who brought AI expertise while insurers focused on domain knowledge and change management.

- They measured and iterated: They defined clear success metrics, tracked them rigorously, and adjusted based on results. They treated AI implementation as a continuous process, not a one-time project.

The competitive advantage of moving now—while there's still differentiation to be gained—is narrowing. The 25% aren't standing still. They're building on their initial successes, expanding to new use cases, and accumulating institutional knowledge about what works.

Your first step isn't purchasing an enterprise AI platform or undertaking a complete system modernization. It's identifying one high-value problem where AI augmentation can deliver measurable results and using that success to build momentum for broader transformation.

The Bottom Line

The question you need to answer isn't "Are we ready for AI?" It's "Can we afford to remain in the 90% while our competitors move to the 25%?"

Ready to Join the 25%?

See how AI-human collaboration works in production with real submissions, real underwriters, and real results.

Request a Demo