What is a Loss Run

TL;DR

- Loss run reports (also called "loss runs") are claim history documents covering 3-5 years of an insured's incidents, payments, and claim statuses—essential for underwriting decisions and pricing accuracy.

- Format chaos is the #1 challenge: Unlike standardized ACORD forms, insurance loss runs arrive in endless formats (Excel, PDF, scanned images, email tables), creating massive processing bottlenecks.

- Manual processing is a time sink: Processing a single multi-coverage submission can take 90-120 minutes of pure data entry, preventing underwriters from doing actual underwriting work.

- Your claims history directly impacts your premium: Frequency, severity, and trends in your loss run report determine whether your insurance costs go up, stay flat, or decrease at renewal.

- Key analysis points: Underwriters look for frequency trends, severity patterns, reserve accuracy, claim timing, and open reserves to assess risk quality and pricing needs.

- Getting loss runs requires strategy: Clear requests with specific timeframes, coverage types, and delivery preferences prevent delays and back-and-forth with brokers.

- Automation is becoming essential: Teams processing 50+ submissions monthly need loss run automation to remain competitive and prevent underwriter burnout.

If you've worked in insurance underwriting or risk assessment for more than a week, you've encountered a loss run report. These documents are foundational to the quoting process—yet they're also one of the most time-consuming documents to process and analyze.

A loss run report (often simply called a "loss run" or "insurance loss run") is a detailed claims history document that insurance carriers provide to show every claim filed under a policy over a specific period, typically 3-5 years. Think of it as your comprehensive claims ledger—a record that underwriters rely on to assess risk, determine pricing, and make coverage decisions.

In this guide, we'll break down what loss run reports are, why they matter, how to interpret them effectively, and why they've become both essential and challenging in modern insurance operations.

What Is a Loss Run Report?

A loss run report is a detailed document of an insured's claim history over a specific period, typically 3-5 years. This claims history report shows every incident, payment, reserve, and status update for a policyholder's coverage.

Insurance carriers generate loss run reports for their current or former policyholders. These reports become critical documents when that business is up for renewal or shopping for new coverage.

- Covers 3-5 years of claim history (some lines require 7-10 years)

- Includes all coverage types (General Liability, Workers' Comp, Auto, Property)

- Shows both paid amounts and outstanding reserves

- Provides claim-by-claim detail plus summary totals

P&C Loss Ratios Hit Critical Levels

According to the American Property Casualty Insurance Association (APCIA), P&C loss ratios reached 78.4% in Q2 2022—the second-highest level in over 20 years.

- What this means: Insurers pay out $0.78 in claims for every $1.00 in premium

- The impact: Combined ratios exceeding 100% across the industry

- The implication: Margin for error is zero—underwriting precision is now a competitive necessity

In this environment, every misread reserve amount and every transcription error in loss run processing directly impacts profitability.

The Format Reality

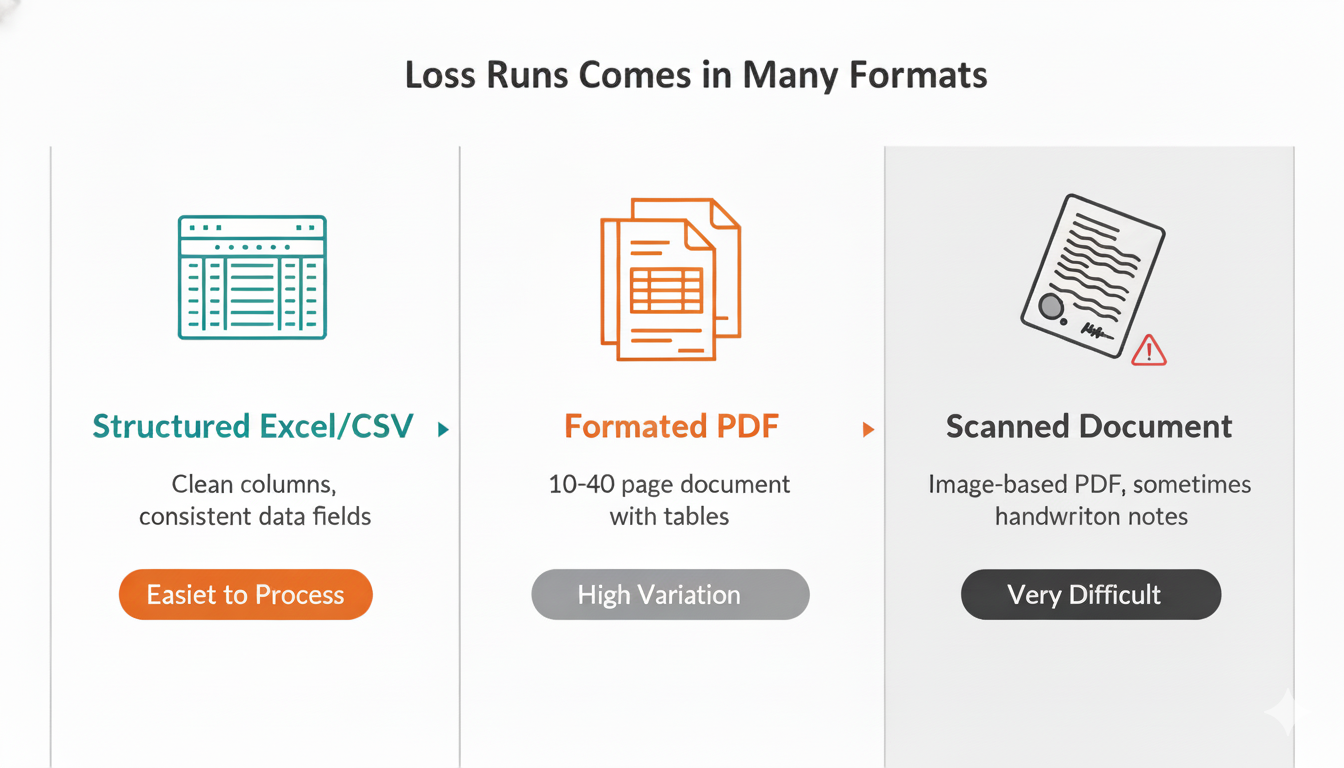

Loss runs arrive in wildly different formats, which creates immediate processing challenges:

Loss runs arrive in Excel spreadsheets from one carrier, 30-page PDFs from another, scanned images from a third, and poorly formatted email tables from a fourth. This format chaos is why loss run processing has become such a significant operational bottleneck.

Unlike standardized ACORD forms, there's no universal loss run template. Every carrier has their own format, structure, and data presentation style.

What Information Does a Loss Run Report Include?

While formats vary significantly across carriers, most insurance loss runs include these core data elements:

- Claim dates (date of loss, report date, closure date)

- Claim types (property damage, liability, workers' comp, auto, etc.)

- Claim descriptions (brief narrative of what happened)

- Claimant information (when applicable)

- Financial details (amounts paid, reserved, and total incurred)

- Claim status (open, closed, closed with payment, subrogated)

- Policy information (policy number, coverage type, limits)

The Interpretation Challenge

Here's where it gets tricky: the same data point can appear in completely different formats across carriers.

One might show "reserves" as a separate column. Another embeds it in a "total incurred" calculation. A third might use "outstanding" instead of "reserves."

This inconsistency means even experienced underwriters need to carefully review each loss run's structure before extracting data. There's no "one template fits all" approach.

How to Read and Interpret a Loss Run Report (with Examples)

Understanding what you're looking at is the first step to interpreting loss run data effectively.

Here's a breakdown of the most common fields and what they mean:

| Field | What It Means | What to Look For |

|---|---|---|

| Date of Loss | When the incident occurred | Check for patterns (seasonal trends, recent spikes) |

| Report Date | When the claim was reported to the carrier | Long gaps between loss and report dates suggest poor claims management |

| Claim Type | Category of claim (GL, WC, Auto, Property) | Frequency by type reveals operational risk areas |

| Claim Description | Brief narrative of what happened | Look for preventable incidents vs. unavoidable accidents |

| Paid Amount | Money already paid out on the claim | Shows actual financial impact to date |

| Reserved Amount | Money set aside for future payments | High reserves indicate uncertainty or ongoing treatment/litigation |

| Incurred Amount | Total of paid + reserved | True cost estimate of the claim |

| Status | Open, Closed, Closed with Payment | Open claims = ongoing financial exposure |

| Claimant | Person or entity making the claim | Multiple claims from same claimant = red flag |

Reading Loss Runs: Practical Examples

Example 1: Clean Loss Run

- 5 years of history

- 2 small claims in Year 1 (both closed, total incurred: $12K)

- Zero claims in Years 2-5

- Underwriter interpretation: Strong risk management, improving trend, favorable pricing

Example 2: Frequency Problem

- 5 years of history

- 3-4 claims per year, all small ($3K-$8K each)

- Total incurred: $95K over 5 years

- Underwriter interpretation: Operational issues, high frequency signals poor loss control, expect 15-25% rate increase

Example 3: Severity Risk

- 5 years of history

- 1 large claim in Year 3: $350K incurred ($200K paid, $150K open reserve)

- 3 small claims spread across other years

- Underwriter interpretation: Severity concern, open reserve creates uncertainty, may require additional information or premium loading

Visual Tip: Most loss runs display information in table format. Some carriers include summary totals at the top or bottom showing aggregate paid, reserved, and incurred amounts by coverage type and year.

What This Means for You as a Business Owner

If you're a business owner shopping for insurance or coming up for renewal, your loss run report is your claims "report card."

It directly impacts what you'll pay.

How Your Claims History Affects Your Insurance

- Zero claims in 3-5 years: You're likely to see competitive pricing and favorable terms at renewal.

- One minor claim: Minimal impact, especially if it was several years ago.

Claim Frequency Drives Pricing

- Multiple small claims each year: Even if individual amounts are low, frequency signals operational risk—expect premium increases of 10-25%.

- 3+ claims in 12 months: Major red flag for underwriters. May result in non-renewal or significant rate increases.

Severity Matters

- One large claim: Underwriters will look at the circumstances. Was it a freak accident or a systemic issue? A single catastrophic loss may not hurt you if your overall history is clean.

- Large open reserves: If you have claims with substantial outstanding reserves, underwriters will price for the worst-case scenario until those claims close.

What You Can Do to Improve Your Loss Run

Before Renewal:

- Close old claims: Work with your current carrier to settle and close lingering claims where possible.

- Implement safety programs: Document improvements you've made (new equipment, training programs, safety protocols).

- Review reserves: Ask your carrier if reserves on open claims are accurate or if they can be adjusted downward based on current information.

- Request a loss run review: Meet with your broker to walk through your loss run and identify any errors or misclassified claims.

At Renewal:

- Highlight improvements: Show underwriters what you've done to reduce risk since prior claims.

- Consider higher deductibles: If you can absorb more risk, a higher deductible can offset premium increases.

- Shop multiple markets: Don't accept the first quote—different carriers weight claims differently.

Questions to Ask Your Broker:

- "How are my claims impacting my premium?"

- "Are there any claims I should dispute or have reclassified?"

- "What can I do to improve my loss history for next year's renewal?"

- "Should I consider a higher deductible to offset rate increases?"

Why Loss Run Reports Matter in Underwriting

Loss run reports tell the risk story that applications and questionnaires can't capture.

They reveal patterns, trends, and risk indicators that fundamentally shape pricing and appetite decisions.

What Underwriters Look For in Loss Run Reports

When analyzing an insurance loss run, experienced underwriters focus on several key indicators:

Red Flags in Claims History Reports:

- Frequency spikes – A sudden jump in claim count, especially in recent years

- Large open reserves – Significant outstanding amounts that could increase total incurred

- Subrogation patterns – Multiple subrogated claims may indicate third-party liability issues

- Late-reported claims – Long gaps between loss date and report date suggest poor claims management

- Severity trends – Increasing claim costs over time, even if frequency is stable

Positive Indicators in Loss Runs:

- Declining frequency – Fewer claims year-over-year shows improving risk management

- Proactive closures – Claims closing within reasonable timeframes

- Reserve accuracy – Final paid amounts close to initial reserves indicate good claims handling

- Clean recent history – No claims in the past 12-24 months

- Small, infrequent losses – Suggests good loss control and safety programs

Understanding these patterns helps you assess whether the risk is improving, stable, or deteriorating.

This directly impacts pricing, terms, and whether you'll quote at all.

How Loss Run Reports Affect Your Insurance Premiums

Underwriters use a clear formula when analyzing loss runs:

Frequency + Severity + Trend = Risk Profile → Premium & Terms

Let's break down how this works in practice.

The Underwriting Math Behind Premium Changes

0 claims in past 3 years

Strong safety program documented

Annual revenue: $5M

Renewal outcome:

- Premium held flat or decreased 5-10%

- Full coverage limits maintained

- Favorable payment terms offered

3 small GL claims per year ($5K-$15K each)

No major severity issues

Similar annual revenue: $5M

Renewal outcome:

- Premium increased 15-20%

- Carrier may suggest higher deductibles

- May require safety audit as condition of renewal

1 large claim ($250K incurred) + several small claims

Large open reserve ($150K) on ongoing litigation

Similar annual revenue: $5M

Renewal outcome:

- Premium increased 30-50%

- Carrier may reduce limits or add exclusions

- May require collateral or payment plan restrictions

- Possible non-renewal

Real-World Example: Workers' Compensation Loss Run Impact

A manufacturing company with 50 employees saw premium impacts based on their loss run performance:

| Year | Claim Activity | Annual Premium | Change |

|---|---|---|---|

| Year 1-2 | Clean loss history | $85,000 | Baseline |

| Year 3 | 2 minor WC claims ($35K total incurred) | $92,000 | +8% |

| Year 4 | 5 WC claims ($120K total, one $50K open reserve) | $135,000 | +47% from Year 2 |

| Year 5 | After safety program: 1 WC claim ($8K) | $118,000 | -13% |

| Year 6 | 0 WC claims | $95,000 | -19% |

This example shows how quickly premiums can escalate with poor loss history. It also shows how proactive risk management can reverse the trend.

What Insureds Can Control

While you can't erase past claims, you can influence future underwriting decisions:

Immediate Actions:

- Increase deductibles: A $5K deductible vs. $1K shows you're willing to share more risk

- Document safety improvements: New equipment, training programs, incident reporting systems

- Close open claims: Work with your current carrier to settle lingering claims

- Review claim descriptions: Ensure accuracy—misclassified claims hurt you unfairly

Long-Term Strategy:

- Implement formal safety programs: OSHA compliance, regular training, incident investigations

- Create a claims review process: Monthly meetings to review incidents and prevent recurrence

- Work with loss control consultants: Many carriers offer free risk assessments

- Track leading indicators: Near-misses, safety observations, training completion rates

The Processing Challenge for Insurance Carriers

Here's where loss run reports become a significant operational challenge for carriers, MGAs, and underwriting teams:

Format Chaos

Unlike standardized ACORD forms, loss runs come in endless formats.

You might receive:

- A structured Excel file from one carrier

- A scanned 30-page PDF from another

- A poorly formatted table embedded in an email from a third

This creates immediate processing bottlenecks.

Manual Data Entry Problems

Most teams still manually key loss run data into rating tools, spreadsheets, or underwriting systems.

Time investment:

- Processing a 5-year General Liability loss run with 30 claims: 45+ minutes

- For a submission with multiple loss runs (GL + Auto + WC): 90-120 minutes of pure data entry

Modern AI-powered loss run processing solutions can extract this data automatically from any format. But many teams are still handling this manually.

Error Risk

Manual transcription introduces errors:

- Misread reserve amount

- Transposed date

- Missed claim

Even a small error in "paid" versus "incurred" amounts can skew loss ratios and impact pricing accuracy.

Volume Bottlenecks

When you're processing hundreds of submissions per month, loss run data entry becomes a massive time sink.

Your underwriters spend more time on data entry than actual underwriting judgment.

Analysis Delays

The longer it takes to extract and organize loss run data, the longer it takes to quote.

In competitive markets, speed matters.

Loss run automation has become a critical efficiency driver for this exact reason.

Working with Brokers and Clients on Loss Run Requests

Getting loss runs from clients is often the first bottleneck in the submission process.

Here's how to streamline this critical step:

How to Request Loss Runs Effectively

When requesting loss runs from brokers or directly from insureds, clarity is key.

Your request should include:

- Specific time period – "Please provide loss runs for the past 5 years (2020-2024)"

- All relevant coverage types – GL, Auto, WC, Property, Umbrella, etc.

- Policy numbers – If known, to help the carrier locate records quickly

- Current carrier information – Carrier name and contact details

- Delivery preference – Direct to you via email, or authorize release to broker

Sample Loss Run Request Email

Subject: Loss Run Request for [Client Name] - [Policy Type]

Hi [Broker/Carrier Contact Name],

I'm working on a renewal/new business quote for [Client Company Name] and need to request loss runs to complete our underwriting review.

Please provide the following:

- Loss run reports for the past 5 years (2020-2024)

- Coverage types: [General Liability / Workers' Compensation / Commercial Auto / Property / Other]

- Current carrier: [Carrier Name]

- Policy number(s): [If known]

Delivery: Please send directly to [your email] or upload to [your portal/system].

If you need a signed authorization from the insured, please let me know and I'll coordinate.

Our target quote date is [Date], so receiving these by [Date] would be ideal to keep us on schedule.

Thank you,

[Your Name]

[Your Title]

Pro Tip: Include your target quote date to create urgency, and offer to help with authorization paperwork to prevent delays.

Common Delays and How to Prevent Them

Typical bottlenecks:

- Incomplete requests – Be specific about what you need upfront to avoid back-and-forth

- Multiple prior carriers – Request loss runs from ALL carriers during the 5-year period

- Authorization issues – Ensure the insured signs a loss run authorization letter

- Carrier processing time – Most carriers take 7-10 business days; request early in the process

- Lost or unavailable records – For very old policies, carriers may not have digital records

What to Do When Clients Can't Provide Loss Runs

Sometimes clients genuinely can't obtain loss runs (dissolved carrier, very old policies, etc.).

In these cases:

- Request signed attestations of loss history

- Review current policy declarations for any reported claims

- Check industry loss databases if available

- Consider requiring higher premiums or specific warranties to offset the uncertainty

Improving Loss Run Processing in Your Workflow

Even without full automation, there are ways to improve accuracy and efficiency in your loss run workflow:

Quality Control Checkpoints

- Double-entry verification – Have a second person spot-check high-value claims

- Reserve vs. paid reconciliation – Ensure reserves + paid = total incurred

- Date logic checks – Loss date should precede report date; report date should precede closure date

- Claim count validation – Does the claim count match what's shown in the summary?

Building Standardized Extraction Templates

Many teams build carrier-specific Excel templates to speed up data entry. While this helps with consistency, limitations include:

- Templates only work for carriers you've seen before

- Format changes break your templates

- Doesn't solve the core problem of manual data entry

- Maintenance overhead as carrier formats evolve

When to Consider Automation

If your team is processing:

- 50+ submissions per month with loss runs

- Multiple coverage types requiring separate loss run analysis

- High-volume lines like Workers' Comp or Auto with lengthy claim histories

...then loss run automation becomes a competitive necessity, not just a nice-to-have.

FAQ for Insurance Professionals

Moving Forward: Working Smarter with Loss Run Reports

Understanding what loss run reports are and how to interpret them is just the foundation.

The real competitive advantage comes from processing them efficiently and accurately at scale.

For teams still manually processing loss runs, the time investment compounds quickly. It takes away from higher-value underwriting activities like risk assessment, broker relationships, and portfolio management.

Modern insurance operations are increasingly turning to loss run automation solutions to eliminate this bottleneck.

Solutions that enable AI-powered loss run processing can extract structured data from any format—without templates, manual data entry, or lengthy IT implementations.

This enables underwriters to focus on what they do best: evaluating risk and making sound underwriting decisions.