The Underwriting Talent Crisis: How HITL AI Bridges the Gap

TL;DR

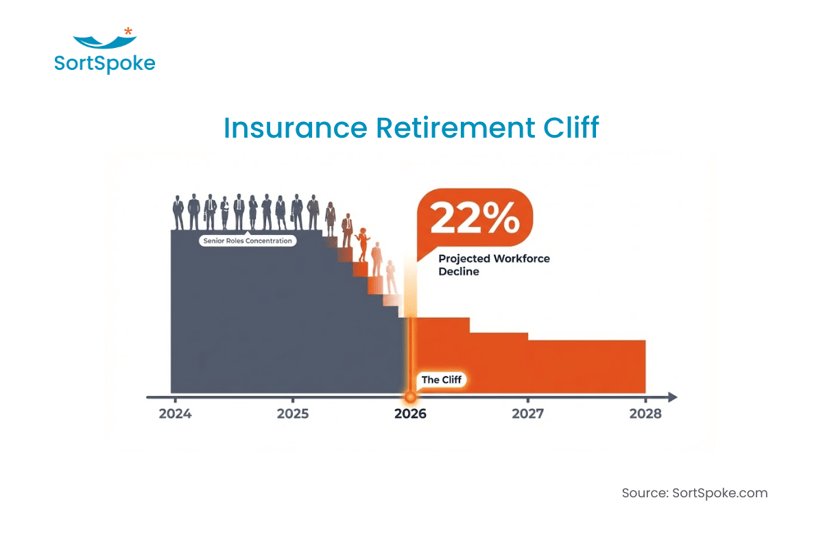

- The 2026 cliff is real: The U.S. insurance sector is projected to lose 400,000 workers by 2026—concentrated in your most experienced roles.

- Experience can't be hired: You can fill seats, but you can't replace decades of accumulated judgment through recruiting.

- HITL AI captures and multiplies expertise: Expert corrections become training data. Junior staff work alongside AI trained on senior judgment. Capacity unlocks without losing quality.

Here's a number that should keep insurance operations leaders up at night: according to Insurance Business Magazine, the U.S. insurance sector is projected to lose 400,000 workers by 2026.

That's not a staffing problem. It's a knowledge crisis.

When a 25-year underwriter walks out the door, they take something that can't be replaced by recruiting: decades of accumulated judgment, pattern recognition for edge cases, and institutional knowledge about how things actually work versus how the manual says they should. You can hire to fill the seat. You can't hire to replace the experience.

The traditional playbook—recruit aggressively, train intensively, document everything—isn't working fast enough. And the alternative many carriers have tried, full AI automation, has failed to deliver at scale. There's a better path, and it starts with understanding what we're actually trying to preserve.

The 2026 Cliff

The retirement wave isn't a future problem. It's happening now.

Those 400,000 departures aren't spread evenly across the workforce. They're concentrated in your most experienced roles—the senior underwriters who handle the complex accounts, the claims adjusters who've seen every edge case, the operations leaders who know why the process works the way it does.

These are the people who:

- Spot the red flag in a submission that looks routine on paper

- Know which brokers require extra scrutiny and which get the benefit of the doubt

- Understand how to price risk that doesn't fit neatly into the rating model

- Remember what went wrong the last time someone tried that "process improvement"

None of that fits in a training manual. Most of it has never been written down. It exists in the heads of people who are counting the days until retirement.

Meanwhile, the pressure to do more with less keeps increasing. Submission volumes are up. Turnaround time expectations are tighter. Competition for profitable business is fierce. And you're supposed to maintain quality while losing your most experienced people.

Why Traditional Solutions Fall Short

The obvious responses to a talent shortage have obvious limitations.

Hiring more people assumes you can find experienced underwriters—and you can't. The talent pool is constrained because everyone else is trying to hire the same people. And even when you find them, it takes years to develop the judgment that makes an underwriter effective on complex accounts.

Training junior staff faster runs into a fundamental constraint: expertise develops through exposure, not curriculum. You can teach the rules. You can't shortcut the pattern recognition that comes from seeing thousands of submissions.

Documenting everything captures explicit knowledge but misses tacit knowledge—the stuff experts do automatically without thinking about it. The process document says "review the loss history." It doesn't capture the thousand micro-judgments that go into what that review actually looks like.

Full automation has been the technology industry's answer, and for complex insurance work, it's consistently failed to scale. Research from Bain & Company shows that while 78% of P&C insurers have experimented with AI in claims operations, only 4% have scaled it meaningfully. The gap isn't capability—it's trust. When teams don't trust AI outputs, they route around the system.

Each of these approaches addresses part of the problem. None addresses the core challenge: how do you preserve and transfer the accumulated expertise of experienced professionals before it walks out the door?

The HITL Difference: Expertise Amplification

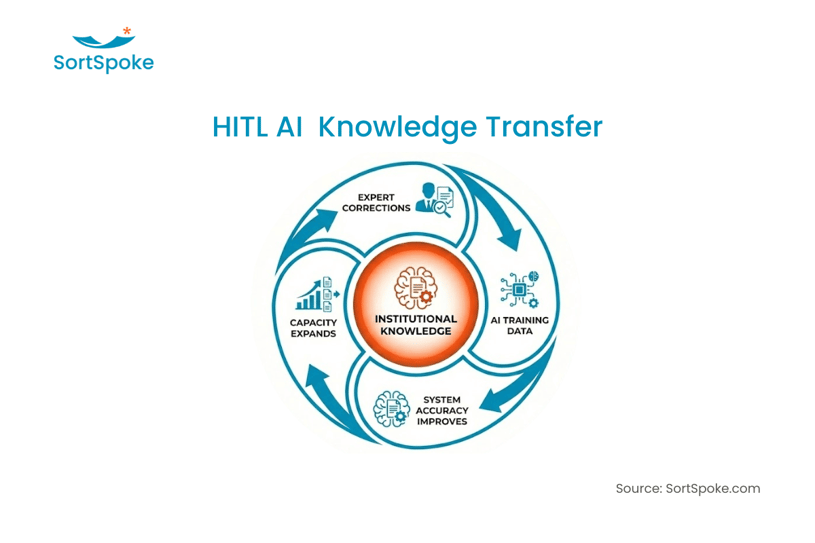

Human-in-the-loop AI offers something the traditional approaches don't: a mechanism for capturing, preserving, and multiplying expert knowledge.

Here's how it works in practice.

When an experienced underwriter reviews an AI-assisted submission analysis, their corrections and adjustments become training data. Every time they say "the AI got this wrong because..." or "you need to also consider..." the system gets smarter. The expert's judgment isn't just applied to one case—it's encoded into the system for every future case.

This flips the knowledge transfer problem. Instead of experts spending hours documenting what they know, they're doing their normal work while the system learns from their decisions. The documentation happens automatically, in the most relevant form possible: actual examples with expert feedback.

The approach we've built at SortSpoke captures this dynamic in real-time. When an underwriter corrects an extraction or adjusts a risk assessment, that correction immediately improves future processing for similar documents—whether it's an ACORD form, a loss run, or a complex schedule of values. Eighteen months of expert decisions can be encoded in the first quarter of use.

But that's only half the equation.

The other half is what HITL AI does for junior underwriters. Instead of struggling alone with complex submissions and hoping they get it right, they work alongside an AI assistant that's been trained on expert judgment. The AI handles the data extraction and pattern matching. The human applies judgment and catches what the AI misses. And a senior underwriter reviews the edge cases.

This isn't replacing human expertise with AI. It's using AI to make human expertise available where it's needed most, when it's needed most.

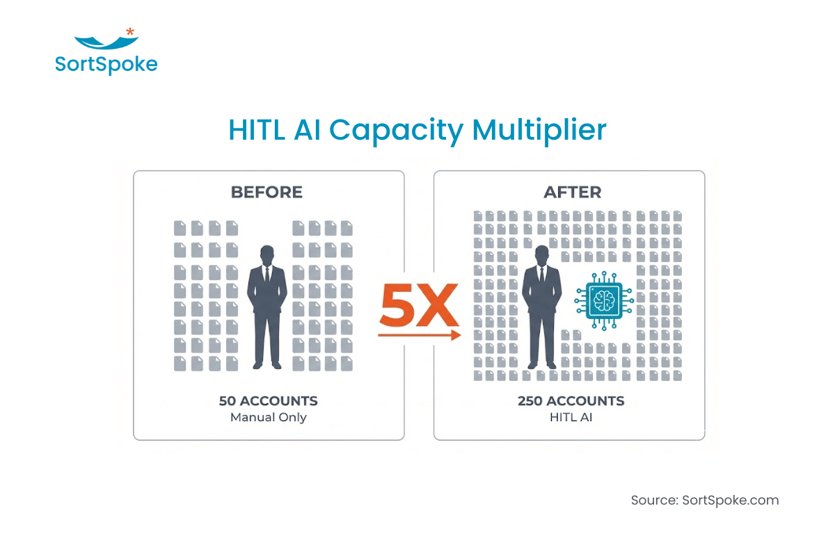

The 5x Multiplier

Research from Bain & Company shows that insurers who've implemented AI holistically across claims operations see a 35% boost in productivity and 50% reduction in processing time.

But the real multiplier effect comes from how HITL AI changes what's possible for your best people.

Your most experienced underwriters are currently spending significant time on work that doesn't require their expertise—data extraction, manual entry, chasing missing information, processing routine submissions that don't need senior review. HITL AI handles that work, freeing experts to focus on the decisions that actually require their judgment.

A senior underwriter who used to handle 50 complex accounts can now handle 250—not because they're working harder, but because they're spending their time where it matters. The AI handles the 80% that's routine. The human focuses on the 20% that requires expertise.

That's how you solve the talent crisis without solving the recruiting problem: you make the talent you have dramatically more effective.

Great American Custom Insurance uses human-in-the-loop AI for unstructured document processing. The result: a 5x efficiency boost—the same team handling dramatically more volume without sacrificing the expert judgment that makes their underwriting effective.

Augmentation, Not Replacement

This distinction matters more than any technology feature.

The insurance industry has been burned by "full automation" promises that didn't deliver. Even as $480M in venture capital flows toward human-centric AI, underwriters are rightfully skeptical of tools that claim to replace their judgment. And leadership teams are wary of investments that sound transformational but end up collecting dust.

HITL AI works because it's designed around augmentation from the start.

An Accenture survey of underwriting executives found that 60% believe AI will augment their workforce—making employees more effective—rather than replace them. Even more telling: 81% expect AI to create new specialist roles, not eliminate existing ones.

The message to experienced underwriters isn't "you're being automated." It's "your expertise is becoming more valuable because we can apply it at scale."

That changes the adoption conversation entirely. Teams embrace tools that make them better at their jobs. They resist tools that threaten to replace them.

The Window Is Closing

The 2026 retirement wave has a specific characteristic that makes timing critical: the people leaving have knowledge that takes decades to develop.

If you start capturing that expertise today—through HITL systems that learn from expert decisions—you have two to three years to encode institutional knowledge into your operations. That's tight, but it's doable.

If you wait, the window closes. The expertise walks out the door without ever being captured. And then you're training AI on junior staff decisions instead of expert judgment.

This is the real cost of pilot purgatory and delayed adoption: not just the efficiency gains you're missing today, but the irreplaceable expertise you're failing to capture while you still can.

Making the Business Case

For operations leaders who need to justify the investment, the math is straightforward.

- Productivity gains: 35% boost when AI is holistically integrated (Bain)

- Processing speed: 50% reduction in processing time (Bain)

- Capacity unlock: Senior underwriters handle 5x the complex accounts

- Knowledge preservation: Expert judgment encoded into system behavior

- Risk reduction: Human oversight catches AI errors before they impact customers

- Regulatory compliance: Audit trails and explainability satisfy emerging requirements

But the number that matters most isn't in any research report. It's the percentage of your most experienced people who are within five years of retirement. That's your knowledge loss trajectory. That's what you're racing against.

The Path Forward

The talent crisis is real. The retirement wave is coming. The knowledge in your most experienced people's heads is irreplaceable.

But it doesn't have to walk out the door.

Human-in-the-loop AI offers a path that addresses all three dimensions of the problem: it captures expertise as a byproduct of normal work, it amplifies the capacity of the talent you have, and it accelerates the development of junior staff. That's why the best insurance AI keeps humans in the driver's seat—and why the staffing models around HITL are evolving just as fast as the technology.

The alternative—waiting for recruiting to solve the problem, or hoping full automation eventually works—means watching your institutional advantage erode year by year.

The question isn't whether to adopt AI. It's whether you adopt an approach that preserves and amplifies human expertise, or one that tries to replace it. One of those approaches is working. The other is how most of the 78% got stuck.

Ready to see how teams are scaling without losing what makes them great? Book a demo to see human-in-the-loop AI in action.