Speed Wins: The First-Responder Advantage in Insurance Submissions

TL;DR

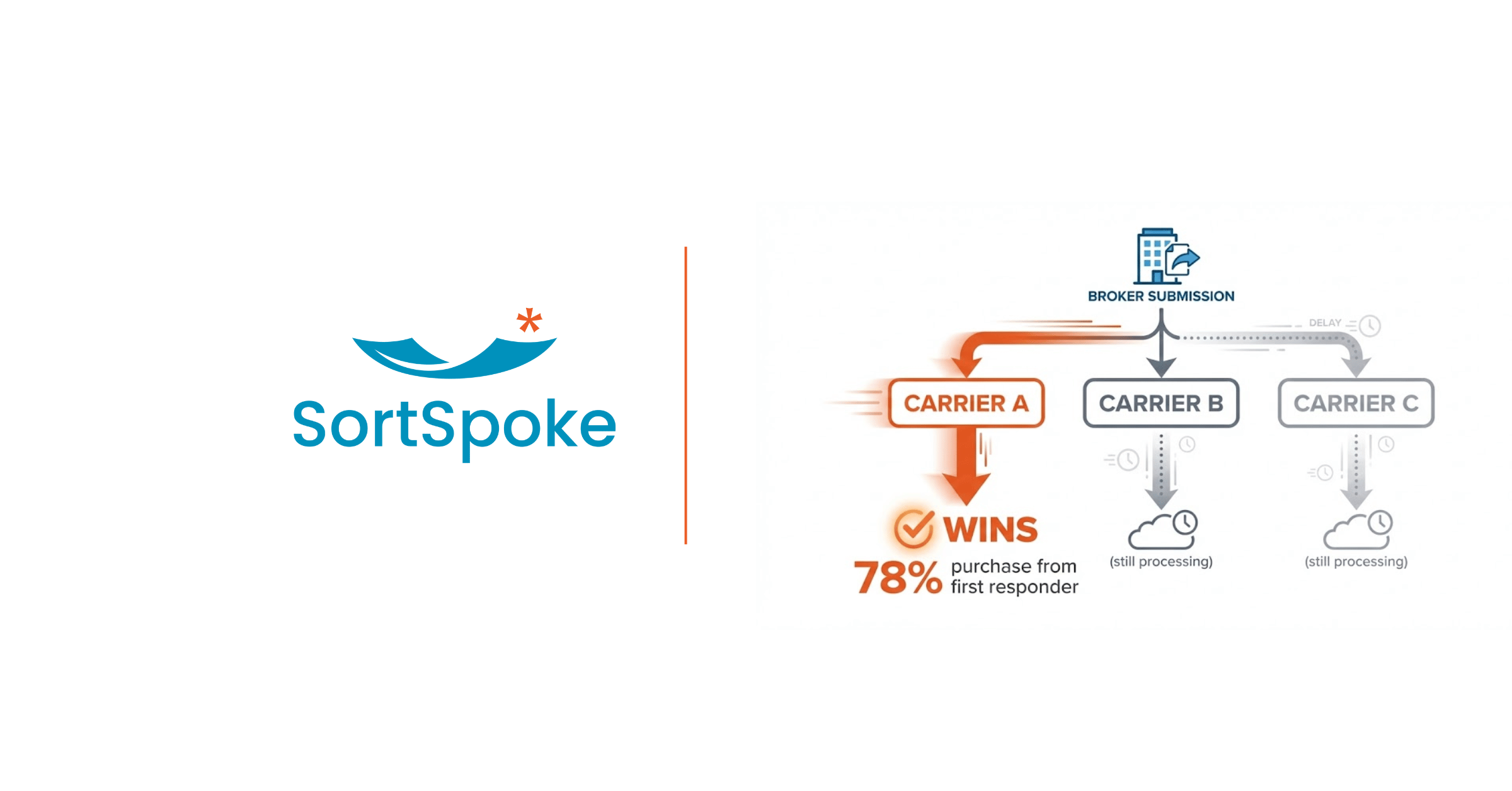

- First-Responder Effect: 78% of buyers purchase from the first responder—speed beats price in competitive situations

- The Industry Gap: Average submission-to-quote takes 8 days, quote-to-bind adds 12 more—that's 3 weeks of opportunity for faster competitors to win

- The Revenue Impact: Moving from 3-day to same-day response can reduce premium attrition by 35%+ on quoted business

- The Shift: Speed isn't just operational efficiency—it's a revenue strategy and competitive moat

There's a stat that should change how every underwriting leader thinks about response time:

78% of buyers purchase from the first responder.

Not the lowest price. Not the broadest coverage. Not the carrier with the best brand recognition. The first one to respond.

That data comes from research published by Coverager, and it aligns with what we're hearing from underwriting leaders across specialty, E&S, and commercial lines: the battle for submissions isn't won during pricing—it's won during intake.

This article breaks down why response time has become the defining competitive factor in submission intake, what "average" actually costs you, and how leading teams are building speed as a sustainable advantage.

The First-Responder Effect: Why Speed Beats Price

The 78% first-responder stat isn't unique to insurance. It reflects a broader pattern in B2B sales: when buyers have multiple options, they often choose whoever reduces uncertainty fastest.

In insurance, this plays out predictably:

- A broker submits to three carriers simultaneously

- Carrier A responds within 24 hours with a clear indication of interest

- Carriers B and C are still triaging on day three

- By the time B and C respond, the broker has already moved forward with A

The 78% stat is reinforced by research from Lead Response Management, which found that responding to inquiries within the first minute can increase conversion by 391%. Wait 5-10 minutes, and qualification rates drop by 80%.

Insurance submissions aren't sales leads, but the psychology is the same: the carrier that responds first signals reliability, responsiveness, and interest. The broker starts building a relationship before competitors even enter the conversation.

What "Average" Actually Costs You

Let's put numbers to what "industry average" response time actually means.

According to Hyperexponential's 2024 market research:

- Average submission-to-quote: 8 days

- Average quote-to-bind: 12 days

- Total cycle: 20 days from submission to bound policy

That's nearly three weeks. In a market where 78% of buyers go with the first responder, a 20-day cycle isn't just slow—it's a competitive disadvantage baked into your operating model.

An 8-day average means some submissions take 3 days and others take 14. The distribution matters as much as the mean. If 30% of your submissions take 10+ days, you're losing those deals to competitors who respond consistently—even if your average looks acceptable.

Here's what the teams hitting competitive benchmarks look like:

- Competitive baseline: Sub-48-hour first touch

- Top quartile: Same-day or next-day response

- Best-in-class: Automated acknowledgment within minutes, substantive response within 24 hours

The gap between "average" and "competitive" is measured in days—and each day costs you deals.

The Revenue Math: Premium Attrition by Response Time

Let's translate response time into revenue impact.

Based on industry patterns and what we're hearing from underwriting leaders, here's the rough relationship between response time and submission attrition:

| Response Time | Estimated Attrition | What's Happening |

|---|---|---|

| Under 2 hours | ~3% | First-responder advantage is yours |

| 2-4 hours | ~5% | Still leading; broker relationship building |

| 4-8 hours | ~10% | Competitive, but faster carriers may have engaged |

| 8-24 hours | ~18% | You're in the mix, but not leading |

| Over 24 hours | ~25% | Faster competitors have likely moved forward |

Example calculation: A team quoting $100M in annual premium with over-24-hour response times is operating at roughly 25% attrition on competitive submissions. Moving to under-2-hour response could recover significant premium opportunity—business that currently walks to faster competitors.

That's not efficiency gains. That's revenue.

Why Brokers Are Shopping: The Loyalty Erosion

The pressure on response time is intensifying because broker behavior is changing.

J.D. Power's 2024 Independent Agent Study found that 54% of agents are actively shopping carriers more than they were two years ago. Broker loyalty is eroding, and carriers that create friction—including slow response times—are losing wallet share.

The same study found that when agents rate carriers highly on trust and responsiveness, 81% say they "definitely will" renew. Trust is built through consistent, predictable interactions—and response time is one of the most visible signals of reliability.

What builds broker trust:

- Consistent response times—brokers know what to expect

- Clear communication—even a decline is better than silence

- Predictable processes—no surprises in how submissions are handled

What erodes trust:

- Submissions that disappear into a black hole

- Inconsistent response times (2 days this time, 8 days next time)

- Chasing for updates instead of being proactively informed

The carriers winning broker loyalty aren't necessarily offering the best rates—they're offering the most reliable experience. And that starts with response time.

Who's Winning: The E&S Lesson

Want a case study in how speed and flexibility drive market share? Look at the E&S segment.

According to Insurance Journal, the excess and surplus lines market grew 12.5% in 2024 to $130 billion in premium—reflecting a 21% compound annual growth rate (Conning Research) and marking seven consecutive years of double-digit growth.

E&S carriers aren't winning because they have better underwriters or lower rates. They're winning because they can move faster and more flexibly than admitted markets. When a broker needs an answer on a complex risk, the E&S carrier that responds in 48 hours wins against the admitted carrier that takes two weeks.

The lesson applies across segments: operational speed is a competitive advantage, not just an efficiency metric.

How Fast Teams Stay Fast

The teams consistently hitting sub-48-hour response times haven't just hired more people. They've fundamentally restructured how submissions flow through their intake process.

Here's what they've built:

Automated Acknowledgment (Immediate)

Every submission receives an automatic acknowledgment within minutes—not a generic auto-reply, but a confirmation that the submission was received, categorized, and assigned. This buys time while signaling responsiveness.

AI-Powered Triage (Minutes, Not Hours)

Instead of manual sorting, leading teams use automated triage to classify submissions by appetite fit, complexity, and priority. Out-of-appetite submissions are declined automatically with clear reasoning. High-value opportunities are flagged and routed immediately.

Pre-Populated Worksheets (Underwriters Analyze, Not Hunt)

By the time an underwriter sees a submission, the key data has already been extracted from documents and populated into a standardized format. Underwriters spend their time analyzing risk, not hunting through PDFs for basic information.

Clear Appetite = Faster Declines

Teams that decline early and confidently free up capacity for submissions that actually fit. A fast "no" is better than a slow "maybe"—for both the broker and your underwriting team.

Building Speed as a Competitive Moat

Here's the strategic question: If 78% of buyers go with the first responder, and your competitors are investing in intake speed, what happens if you don't?

The answer is straightforward: you lose market share to teams that respond faster. Not because your underwriting is worse—because your intake is slower.

Speed is becoming a durable competitive advantage because it compounds:

- Faster response → higher win rate → more bound premium

- More premium → better broker relationships → more first-look opportunities

- More first-looks → more data on what's binding → better appetite refinement

The teams investing in intake speed aren't just improving efficiency—they're building a flywheel that gets stronger over time.

Not sure where to start? See Your First 30 Days: A Practical Playbook for week-by-week steps to measure your response time baseline and implement quick wins.

Ready to compress your intake cycle? Book a demo to see how leading teams achieve sub-48-hour response times.